Turn CAC Losses Into Rank Wins

💡Turning “Dead” DTC SKUs into Amazon Rank Builders, OpenAI Shares Data on ChatGPT Usage and Global Trends, and more!

Hey there Smarty 👋

Are you geared up to catch the latest and greatest in quick shorts?

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe here! That way, you’ll never miss out on the trending shorts.

💡 Turn CAC Losses Into Rank Wins

Most brands kill low-CVR products. But the best operators? They reassign roles.

A SKU that doesn’t convert profitably on your site can still fuel discovery, category rank, and purchase intent on Amazon. This strategy doesn’t rely on A9 loopbacks or affiliate hacks.

It’s a capital recovery engine, using sunk CAC to feed high-return placements inside a channel where conversion behavior is structurally better.

The 3-SKU Role Map: Convert, Redirect, or Rank

Here’s the mental unlock: not every SKU should convert. Some should attract, then reroute. Others should amplify rank for your core products. Break your catalog into these three roles:

- Converter SKUs – Your usual winners. Convert fast on DTC or Amazon.

- Redirect SKUs – High-click, low-convert DTC SKUs. Perfect to reroute to Amazon via landing pages, email flows, or even checkout interruption.

- Rank Builders – Hero ASINs on Amazon that benefit from warm, redirected traffic, even if it came from “failed” DTC products.

By tagging and tracking SKU role performance, you shift from flat attribution logic to multi-role SKU economics.

🔁 How the Redirection Mechanism Works

Let’s say a skincare brand has a $12 trial-sized mask that underperforms on DTC. Instead of cutting it, they push it via email and TikTok ads, but now with a “Buy on Amazon” CTA. That click is no longer wasted CAC, it’s recycled traffic that drives session signals and conversion uptick for their $38 bestseller bundle ASIN.

This move:

- Converts better due to Prime trust and speed

- Triggers higher session depth and bundles

- Boosts the target ASIN’s Amazon category rank

You’re not optimizing CVR, you’re orchestrating behavior across platforms.

When “Losing” SKUs Become the Smartest Inputs

This is especially lethal in Q4, when CAC spikes and competition crowds DTC channels. Your weak SKUs become behavioral magnets that offload CAC burden and keep your Amazon velocity high without burning PPC budget.

One caveat: only redirect SKUs with good review profiles, clean returns data, and complementary purchase patterns to your hero ASINs.

Why Publishers Love These Redirect SKUs

During the holidays, major editorial publishers aren’t just looking for hero products, they’re sourcing high-click catalog fillers that slot into gift guides, reviews, and affiliate lists.

Levanta connects select 7–9 figure marketplace brands with top publishers looking for these redirect-ready SKUs. You can see if your brand qualifies for Q4 placements that deliver external traffic and Amazon rank acceleration.

Together with Portless

📦 BFCM is Weeks Away. Make Sure Your Inventory Isn't.

Your competitors are panicking. Their BFCM inventory is sitting on a container ship somewhere in the Pacific, arriving (maybe) by late November.

You could be selling next week.

With direct fulfillment, Portless cuts your inventory lead times by 90%, meaning you start generating cash flow immediately, not in late November.

Here's how Portless gets you selling for BFCM faster:

✈️ Onboard inventory from your factory in 1 week (not 60-90 days)

📦 Start selling immediately while others wait for containers

💰 Generate cash flow now to reinvest in BFCM marketing

🚀 Restock winners in 3-5 days throughout the entire season

With Portless, you'll be 3 months ahead of brands waiting for containers. That's 3 extra months of sales, reviews, and cash to make this the best BFCM ever.

The math is simple: Start selling your products in 1 week or wait until November.

📊 Want to start selling before your competitors even receive inventory?

Get a custom quote for your brand now →

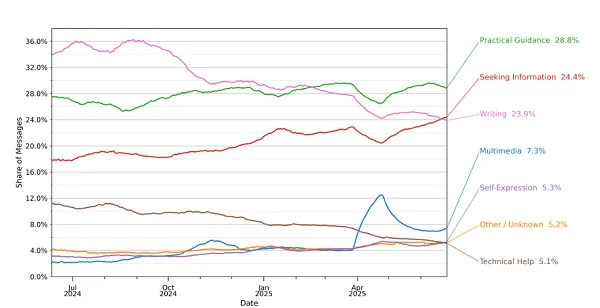

📊 OpenAI Shares Data on ChatGPT Usage and Global Trends

OpenAI’s newest report reveals how ChatGPT usage has surged and evolved, drawing insights from 1.5 million conversations over three years. The findings highlight a broadening user base, changing usage patterns, and a growing economic footprint.

The Breakdown:

1. Explosive User Growth - ChatGPT has skyrocketed from just 1 million active users in late 2022 to 700 million weekly active users today, making it one of the fastest-growing consumer AI products ever tracked.

2. Shifting Usage Patterns - Seventy percent of usage is non-work related, while both personal and professional uses rise steadily. Practical Guidance holds steady at 29% of all conversations, Writing has dropped from 36% to 24%, and Seeking Information climbed from 14% to 24%. Asking (49%) is now the most common interaction type, followed by Doing (40%) and Expressing (11%).

3. Global Reach and Inclusion - The gender gap has effectively closed, with female-identifying names increasing from 37% to 52% of users between early 2024 and mid-2025. Growth in low-income countries is particularly strong, outpacing high-income regions by a factor of four.

ChatGPT now drives everyday decision-making and productivity gains, embedding itself in both work and personal routines worldwide. Its rapid adoption shows AI is becoming a default discovery and problem-solving tool across markets. This means investing in AI-friendly content and conversational touchpoints is critical.

🚀Quick Hits

🚀 Ship, brief, launch in 48 hours. Insense makes UGC that simple. Instead of chasing creators, you tap a global pool of 68,500+ specialists who deliver on-brand content in 48 hours. That’s how Nurture Life cut turnaround from 2 months to 2 weeks with a single marketer. Book your free strategy call before Sept 19th and claim your $200 bonus.

🔎 Google’s removal of the 100-results-per-page option is disrupting rank tracking, leaving Search Console and third-party tools with inaccurate, confusing organic ranking data and forcing urgent updates for reliable SEO reporting.

📰 A U.S.-brokered framework for TikTok’s sale to an unnamed American investor is reportedly set, allowing ByteDance to retain a stake while meeting legal requirements, potentially ending the long-running U.S.-China TikTok standoff.

📊 X hit a record week of first-time downloads, with daily active users up 5.6% in the U.S. and 2.2% globally, but long-term usage remains unclear despite the short-term spike in app rankings.

💡 Google will auto-enable “Store Visits” conversions on Oct. 8, assigning a preset value of ~$220 per visit, which could inflate reported ROAS and spend despite relying on modeled, not actual, sales data.

That’s a wrap for today! Tell us your thoughts about today's content as we line up more Shorts! And don’t hesitate to share this with someone who’d adore it. 🥰