TikTok Shop Punishes Impatience

Hey there Smarty 👋

Are you geared up to catch the latest and greatest in quick shorts?

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe here! That way, you’ll never miss out on the trending shorts.

Together with Levanta

Find the Revenue You’re Missing. Lunch Included.

Most marketplace sellers run affiliates because they’re supposed to.

At month end, almost no one can answer one question: what actually made us money.

Creators drive traffic, marketplaces capture the sale, and you’re left guessing which efforts actually paid off.

Levanta fixes it by turning affiliates into a real performance channel across Amazon and Walmart. You see exactly which creators drove sales, which marketplace converted, and what’s worth scaling again.

With Levanta, sellers can:

- Partner with 50,000+ vetted creators and affiliates

- Track clicks, sales, and ROI with clear analytics

- Amplify what works and stop paying for what doesn’t

- Manage creators, commissions, and payouts across marketplaces with ease

Over 3,000+ marketplace brands use Levanta to drive 274% sales lift, 3× ROAS, and over 73% of sales attributed directly to affiliates.

After that, decisions get obvious. You stop guessing and start scaling with proof.

Qualified sellers who book a demo will receive a $75 Uber Eats or DoorDash gift card. Eligibility confirmed after booking.

🤷♂️TikTok Shop Punishes Impatience, Not Bad Strategy

TikTok Shop has a nasty habit of exposing how leadership actually handles pressure.

It doesn’t show up in the pitch decks or the weekly meetings. It shows up in how long a team is willing to stay uncomfortable.

The fastest way to kill momentum on this platform isn't bad creators or weak hooks. It’s pulling the plug too early because the numbers don’t look the way traditional channels trained everyone to expect.

Most marketing teams are conditioned to look for immediate efficiency. Spend a dollar, get two back. If the curve doesn’t tighten up quickly, the assumption is that something is broken. But on TikTok Shop, that instinct is expensive.

Early performance is supposed to be noisy.

In the beginning, the algorithm isn’t trying to optimize for margin. It is trying to figure out if the shop is safe to scale. It’s watching fulfillment consistency, review velocity, refund rates, and how fast customer service replies.

It’s building a trust profile, not a profit profile.

To a CFO, none of that looks like ROI. It just looks like spending money without a safety net.

This is why so many launches stall right after they start "working." A few creators hit, GMV spikes, and then leadership tightens the leash. They cut sampling budgets, pause ads, or demand profitability before the system has finished learning.

From the platform’s perspective, that doesn't look like financial discipline. It looks like instability.

Volume appears, then disappears. To the algorithm, that signals risk. And risk gets deprioritized immediately.

The brands that actually make it through this phase have a different relationship with time.

They treat the first few months as "signal acquisition," not profit extraction. They stop looking at ROAS and start looking at presence:

- Are more creators posting?

- Is the Shop Health score staying green?

- Are customers coming back unprompted?

Those are the indicators that matter before efficiency ever does.

Once that foundation exists, profitability becomes easier. Ads amplify proven content instead of guessing. Affiliates stick around because the system feels reliable.

TikTok Shop doesn’t reward perfection. It rewards continuity.

If a business can stay present long enough for the system to trust it, the economics usually follow. If not, no amount of tactical optimization will save it.

The question isn’t whether TikTok Shop works. It’s whether the team is willing to let it work long enough to prove it.

🎯 Social Platforms Are Rewiring How Content Gets Seen and Sold

Two big platform updates signal a deeper shift. Meta is rethinking how relevance is measured in feeds, while TikTok is removing friction from commerce creation. Together, they’re changing how reach, engagement, and sales are earned.

The Breakdown:

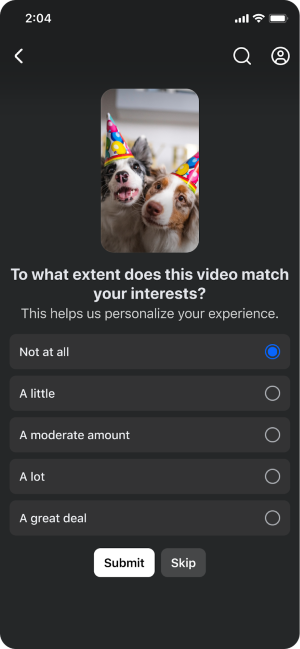

1. Meta is moving beyond likes and watch time - Facebook Reels now relies on direct user feedback instead of only engagement signals, helping the system understand what people actually enjoy, not just what they pause on or watch passively.

With its User True Interest Survey model, Meta improved alignment between users and content from around 48% to over 70%, surfacing more niche, high-quality Reels and driving better engagement satisfaction.

2. TikTok is compressing content creation for commerce - TikTok Shop launched AI tools that convert product images into videos, auto-generate scripts with AI dubbing, and create full listings, making shoppable content faster and easier to produce.

By automating video creation, voiceovers, and product listings, TikTok lets merchants go live with less effort, lower costs, and fewer dependencies, making it easier to scale catalogs and test demand quickly.

The takeaway is clear: Meta is rewarding genuine relevance, while TikTok is rewarding speed. Brands that focus on real user interest and rapid execution will be better positioned to win reach, engagement, and conversions going forward.

Together with The Shift

Turn AI from “Interesting” to “Impactful”

If you’ve ever thought, “That’s cool, but how would I actually use it?”

The Shift is for you. Here’s what you’ll get:

- Easy-to-follow breakdowns of even the most complex AI concepts.

- Real strategies you can apply in minutes, no tech degree required.

- Bonus access to 3,000+ AI tools, free courses, and prompt libraries.

Every edition is built for action, so you can improve campaigns, speed up workflows, or launch ideas faster than ever before.

You don’t just “learn AI” here. You make it work for you.

🚀Quick Hits

📉 Strong creative cannot fix the wrong creator. Maty’s achieved 12× higher reach and roughly $0.60 CPC on TikTok Spark Ads by tightening creator-brand fit before launch. Insense matches marketers with high-fit creators in under 48 hours, so media works harder. Book a free strategy call and get $200 toward your campaign.

📈 Google Search ad clicks just hit a 5 year high as Q4 spend rose 13% YoY, Shopping spend jumped 16% YoY, and CPCs stayed flat to slightly down, creating a rare “more demand, same cost” efficiency.

🚨 OpenAI is testing ads in ChatGPT (U.S.) soon, showing clearly labeled sponsored placements at the bottom of relevant responses for free users and ChatGPT Go, while Pro, Business, Enterprise, and under 18 stay ad-free.

🚫 Free subdomain hosting can quietly kill SEO, because spammy neighbors drag down trust signals even if your site is clean. Mueller’s point is simple, pick a real domain, earn direct traffic first, then fight crowded topics with a sharper angle.

📱 2025’s mobile app boom is about spending, not downloads: global in-app revenue hit ~$156B, up 21% YoY, even as downloads fell to 107B. Subscriptions now drive ~96% of store spend, with annual retention at 41%.

That’s a wrap for today! Tell us your thoughts about today's content as we line up more Shorts! And don’t hesitate to share this with someone who’d adore it. 🥰