The ROAS See-Saw Effect

📉Your ROAS didn’t drop because your ads got worse, Google Escapes Breakup, Faces Data Sharing & Deal Limits, and more!

Hey there Smarty 👋

Are you geared up to catch the latest and greatest in quick shorts?

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe here! That way, you’ll never miss out on the trending shorts.

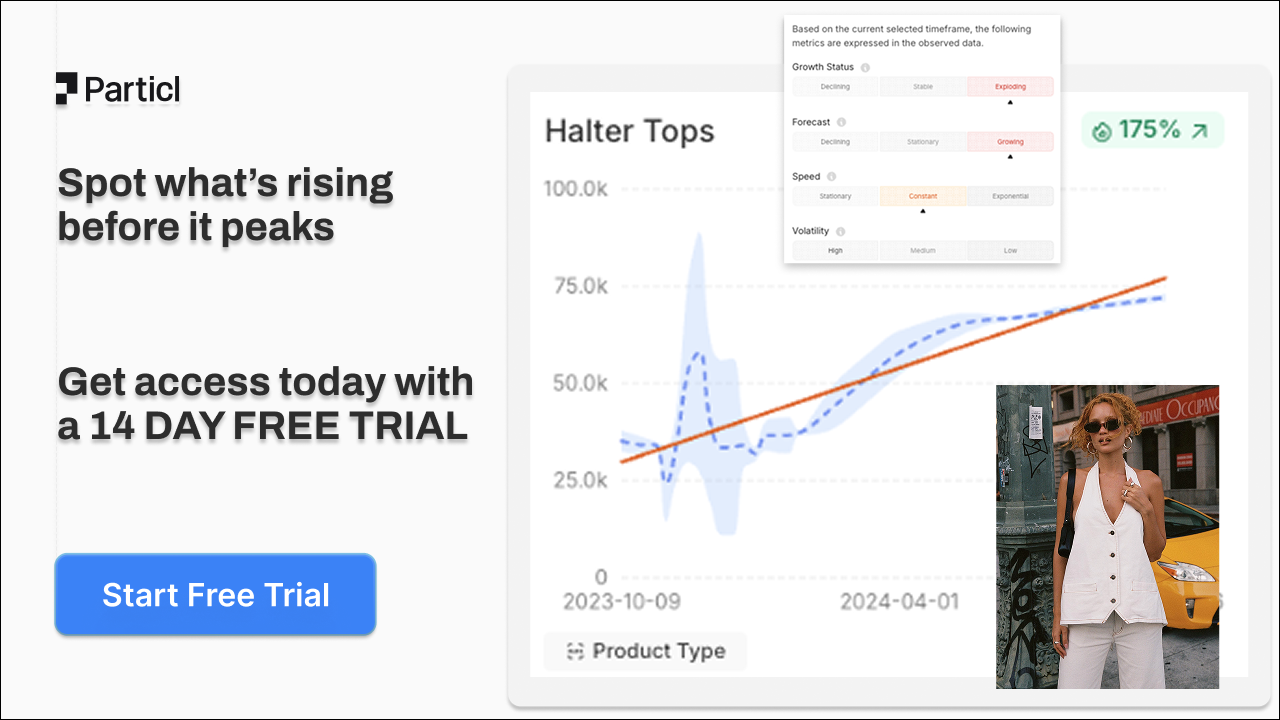

Together with Particl

See the Wave Before Everyone Else Rides It

Missing a trend isn’t just bad luck; it’s lost revenue. By the time most brands notice what’s rising, competitors are already running ads, filling carts, and capturing market share.

That delay costs more than sales; it leaves your entire growth strategy reactive.

With Particl’s Trends Tool, you:

📈 Spot which product categories are gaining momentum

🏷 Track keywords before they flood paid channels

👗 Identify materials, styles, and aesthetics spiking in popularity

🔍 See which companies are pulling ahead in real time

This isn’t guesswork or social media hype; it’s powered by real consumer data trusted by 10,000+ brands like Skims, Mejuri, and Vuori to anticipate demand before it’s obvious.

The question is simple: will you ride the next wave, or miss it watching competitors cash in?

Start your 14-day free trial today!

📉 The ROAS See-Saw Effect: Why Most Creatives Break at Scale

Your ROAS didn’t drop because your ads got worse.

It dropped because your audience shifted, and your creative couldn’t carry the load.

That’s the core of the ROAS See-Saw Effect: when spend goes up, performance crashes… not from fatigue, but from fragility.

What scales isn’t just spend. It’s resonance. And most brands have no way of measuring how far their best creative can stretch before it snaps.

🧠 The ROAS Elasticity Map

Most teams look at ROAS as a static stat. But elite teams treat it as a dynamic curve, constantly reshaped by budget, audience type, and creative durability.

Here’s the real insight: Every ad has a breaking point.

- Ad A might perform at 3.4x at $20K/month, but drop to 1.2x at $80K.

- Ad B might look average at $5K, but it compounds at scale because it speaks to broader cold traffic.

The fix? Build a ROAS Elasticity Map:

- Track ROAS changes per $10K spend increment, per creative.

- Mark when returns start degrading.

- Pinpoint your elastic zone, where scale still compounds.

This lets you forecast profitability ceilings per asset, instead of guessing blindly.

🎯 Micro-ROAS Analysis: The Only Metric That Matters

Campaign-level ROAS is a lie.

It hides how much each creative is actually contributing, especially when nested in CBOs or scaling structures.

Instead, track Micro-ROAS per Creative Block:

- Measure ROAS per concept, not campaign.

- Flag fragile creatives that tank performance beyond a narrow spend window.

- Identify which visuals, CTAs, or UGC types can handle heavier cold traffic loads.

The payoff? You stop pausing ads that are “underperforming” at scale but thriving in their ideal spend band.

🧪 Creative Stress Windows (not Fatigue)

Most marketers panic at signs of ad fatigue.

But it’s not fatigue, it’s stress failure. Creatives aren’t designed to scale evenly.

Use Creative Stress Windows to:

- Set a minimum and maximum effective spend range per creative.

- Label assets as “Precision Ads” (low-budget sniper creatives) vs “Compounders” (broad scaling ads).

- Avoid pushing high-ROAS ads into collapse by forcing them past their stress zone.

Treat your creative portfolio like an investment fund:

- Some assets are volatile.

- Some are safe bets.

- The best ones compound slowly and consistently.

🧠 Why This Works

Every creative has a capacity threshold, and most brands have no visibility into where that line is. ROAS See-Saw is not a media buying failure. It’s a creative architecture failure. This system turns scale into a diagnostic layer, not a gamble.

Together with The Operator’s Stack

The $9 Decision That Could Save Your Quarter

Every quarter, another channel slips away. CAC climbs, conversions shrink, and leadership asks for answers you don’t have. The funnel didn’t break; the market evolved faster than your playbook.

Rewriting the DTC Rulebook is built from campaigns that sold to the toughest buyers. Inside, you’ll get:

- Storytelling frameworks that turn attention into trust

- Value-mapping canvases for clearer positioning

- Referral and cashflow calculators for growth without waste

- Unit economics analyzers that expose hidden profit leaks

- Outreach libraries with 50+ proven templates

- Supplier negotiation toolkits that give you leverage instantly

On top of that, you’ll unlock two pro-level playbooks and 2,000+ Viral Video Hooks (updated monthly).

That’s over $900 of execution-ready strategy for just $9. No theory. No filler. Just tools you can deploy today.

Get your copy now and stay ahead before the next quarter’s numbers land!

⚖️ Google Escapes Breakup, Faces Data Sharing & Deal Limits

A federal court has finalized remedies in Google’s monopoly case, stopping short of a breakup but imposing new restrictions on how it operates. Judge Amit Mehta’s decision focuses on data access and contract changes rather than structural separation.

The Breakdown:

1. No Forced Breakup of Chrome or Android - The court rejected calls to divest Chrome or Android, ruling such steps would overreach. Instead, Judge Mehta targeted Google’s distribution practices, barring exclusive search agreements while still allowing payments for placement.

2. Required Data Sharing with Competitors - Google must share certain search index and user-interaction data with “qualified competitors,” though ads data is excluded. Syndication services must also be offered under standard commercial terms to enable rivals to build competitive search products.

3. Exclusivity Ban on Distribution Deals - Exclusive contracts tying Google Search, Chrome, Assistant, or Gemini to devices or licenses are now prohibited. Phone makers and carriers will need to renegotiate agreements under the new rules, which aim to open distribution to alternatives.

4. Six-Year Oversight Window - The remedies will take effect 60 days after the final order (expected after Sept 10) and run for six years, overseen by a technical committee. Google has said it will appeal, warning that mandated data sharing risks exposing trade secrets.

Google avoids the most severe outcome, being broken up, but will now face years of regulatory oversight. The new rules weaken its control over default search placements and force limited data sharing, giving rivals a chance to chip away at its dominance in general search.

🚀Quick Hits

📊 Most eCom brands are stuck waiting months for inventory, bleeding sales, and burning cash. Portless flips that factory-to-customer in 6 days, restocks in 3–5, no warehouses, no waiting. It’s the speed moat every brand needs this Q4. Get your custom quote now!

📊 Instagram reached 281.8M EU users, outpacing Facebook’s 263.6M, growing 6.17% vs 0.65% since March 2024. Facebook lost users in several countries, while Meta emphasizes overall “Family of Apps” growth.

📈 TikTok’s EU audience surged to 170M users (+25% since 2023). Despite cutting moderation staff by 26%, stronger AI detection boosted safety enforcement, with 24.5M posts and 2.5M ads removed.

🛑 Meta added a “Restricted Words” option in Advantage+ campaigns, giving advertisers control over AI-generated copy, enhancing brand safety, and supporting Meta’s broader push toward fully AI-driven ad campaigns.

📈 LinkedIn’s EU users grew 14% to 54.7M MAU, though only 36% of members are active monthly. Strongest growth came from smaller markets, while moderation staff expanded amid rising misinformation and harassment reports.

That’s a wrap for today! Tell us your thoughts about today's content as we line up more Shorts! And don’t hesitate to share this with someone who’d adore it. 🥰