The Cost Cap Delusion

🚀 Why Meta’s AI Is Optimizing for the Wrong Buyers, The Evolution of Consumer Review Behavior, and more!

Hey there Smarty 👋

Are you geared up to catch the latest and greatest in quick shorts?

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe here! That way, you’ll never miss out on the trending shorts.

🚀 The Cost Cap Delusion: Why Meta’s AI Is Optimizing for the Wrong Buyers

You set a cost cap, thinking it’s keeping your CAC low. But here’s the reality—cost caps aren’t protecting your margins, they’re killing your growth.

Meta’s AI isn’t designed to find the best customers. It’s designed to hit your cost target, even if that means sending you low-LTV buyers, serial returners, and discount chasers. The result? A slow death spiral where your ads look efficient but your business stops scaling.

Here’s why cost caps are silently working against you—and how to fix it before it’s too late.

1️⃣ Your Best Buyers Get Filtered Out

Cost caps force Meta to prioritize the cheapest conversions, not the most valuable ones. If someone costs more but is 5x more profitable, Meta ignores them.

This means:

- Fewer repeat buyers – You attract shoppers who never return.

- More serial returners – Easy conversions often lead to refunds.

- Low-quality lookalikes – Your future ad sets get trained on the wrong people.

Your cost per acquisition might look great, but your true customer value is tanking.

2️⃣ You Starve Your Retargeting Pipeline

When Meta limits spend to only “cheap” audiences, your top-of-funnel dries up. No new high-quality users = weak retargeting pools = declining conversions over time.

Instead of feeding Meta more high-value signals, you shrink your future customer base.

3️⃣ You Enter a “Cheap Customer” Death Spiral

Meta optimizes based on past buyers. If all it sees are low-intent shoppers, it keeps sending you more of them. Over time, your entire audience gets worse.

This is how brands lose ad efficiency and don’t even realize it.

The Fix: Bidding for Long-Term Growth, Not Cheap Wins

Train Meta to Prioritize High-LTV Buyers

Stop restricting spend too early. Instead:

- Start with Highest Value bidding for 5-7 days—let Meta find your best buyers.

- Exclude serial returners from targeting—don’t let bad buyers ruin your data.

- Apply cost caps only after Meta has learned who converts best.

This way, cost caps enhance your ad performance instead of sabotaging it.

Structure Ad Sets by Buyer Intent

The best brands don’t just set cost caps across the board. They bid differently for different customer behaviors:

- Retargeting & high-intent buyers → Cost Caps

- Cold audiences & new prospects → Highest Value

- LTV-driven lookalikes → Lowest Cost

This balances profitability with long-term scale.

Final Takeaway: Stop Optimizing for Cheap, Start Optimizing for Scalable Profits

Cost caps work only when used strategically. The best advertisers aren’t bidding for the cheapest conversions. They’re bidding for the right ones.

Because in 2025, brands that train Meta to optimize for customer quality—not just cost—will dominate.

Together with Insense

Find your perfect niche influencers within 48 hours

Fact: Nailin' that creator-brand alignment is the secret to high-performing UGC and influencer partnerships

Problem: Manually sifting through thousands of creators to find the perfect match is a time-consuming nightmare.

Solution: Insense.

You need Insense’s carefully vetted marketplace of 60,000+ UGC creators and micro-influencers from 20+ countries across the USA, Canada, APAC, and Latin America.

Dermatologists for your skincare brand? They’ve got it! Watch collectors? LGBTQ+ creators? They’ve got it!

2,000+ e-com, DTC, and Amazon brands are using Insense to find their perfect niche creators and run diverse collaborations from product seeding and gifting to TikTok Shop and affiliate campaigns, and whitelisted ads.

- Quip - received an 85% influencer activation rate (32/37 influencers posted)

- Any Age Activewear - quickly matched with mature female creators aged 50+ which boosted AOV by 20%

Try Insense yourself!

Book a discovery call by March 7 and get a $200 bonus for your first campaign.

📢 The Evolution of Consumer Review Behavior

Insights from BrightLocal

The 2025 Local Consumer Review Survey by BrightLocal examines 15 years of shifts in how consumers search for businesses, trust online reviews, and leave feedback highlighting key changes in review habits, platform preferences, and the evolving role of alternative review sources.

The Breakdown:

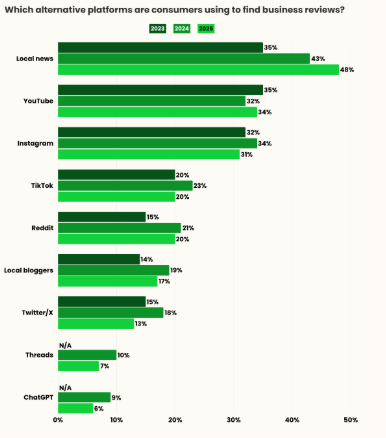

- Shifting Consumer Search Behavior – Online searches for local businesses remain high, with 53% searching daily in 2025, though down from 59% in 2020. While Google leads with 83%, alternative platforms like local news (48%) and YouTube (34%) are gaining popularity, while Facebook and Yelp decline.

- Declining Trust in Reviews – Consumer trust in online reviews has dropped from 84% in 2017 to 42% in 2025, driven by concerns over fake reviews and exaggerated ratings. Amazon (50%), Google (40%), and Facebook (42%) are the most cited platforms for fake reviews, impacting credibility.

- Evolving Review-Writing Trends – 75% of consumers still write reviews annually, but new platforms are emerging. YouTube, Instagram, and TikTok are increasingly used for business feedback.

- Future of Consumer Review Behavior – Review expectations are changing, with recency becoming less critical (only 21% prioritize reviews from the past two weeks). Apple Maps and other platforms are evolving their review features.

Consumer trust in reviews is evolving, requiring businesses to focus on authenticity, monitor emerging platforms, and engage with audiences across multiple channels. Social media, video reviews, and alternative sources are shaping future reputation management, making adaptability key to staying competitive.

🚀 Quick Hits

❓ Want to Scale Faster With AI & LinkedIn? Discover the $100K LinkedIn strategy and how AI can help automate lead gen, land high-paying jobs, and grow your business effortlessly. This workshop is FREE for the first 100 participants—grab your spot today!

🫵🏻 90% of US teens use YouTube, far outpacing TikTok (63%) and Instagram (61%). YouTube ads now generate $36.15 billion, doubling their share of Google’s revenue. Shorts drive nearly 6% engagement, making them a powerful brand awareness tool. YouTube's ROI surged 11% in 2024.

🔍 Google now processes 5 trillion searches annually, more than 158,000 per second. This is the first official update since 2016 when searches surpassed 2 trillion. Google also hinted at a rise in commercial queries following the introduction of AI Overviews.

💬 Google has renamed "Conversion Settings" to "Key Event Setup" in Google Merchant Center, aligning with Google Analytics 4’s "key events" terminology standardizing measurement terms across platforms, impacting workflows, reporting, and strategic measurement of customer interactions.

🎫 Half of consumers would switch retailers for a coupon, with 45% citing discounts as a key motivator. Top offers shoppers crave include BOGO (72%) and markdowns (65%). Email (59%) is the preferred way to receive deals, while 61% want loyal customer rewards.

That’s a wrap for today! Tell us your thoughts about today's content as we line up more Shorts! And don’t hesitate to share this with someone who’d adore it. 🥰