Most Creator Ads Ask Too Much

🗣️They force decisions instead of guiding exploration, TikTok’s 2026 playbook for growth & commerce, and more!

Hey there Smarty 👋

Are you geared up to catch the latest and greatest in quick shorts?

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe here! That way, you’ll never miss out on the trending shorts.

🗣️ Most Creator Ads Ask Too Much

Creator ads fail when they’re treated like smaller billboards.

A product is shown. A benefit is claimed. A link is dropped. Then everyone waits for clicks and hopes intent magically appears on the other side.

That’s not how people buy.

What actually happens is quieter. Someone sees a creator and thinks, “Wait… would this even work for me?” That question is the moment that matters. Not the click.

The job of a creator isn’t to close. It’s to surface the exact uncertainty sitting in the buyer’s head and make it feel safe to explore.

That’s why Click-to-WhatsApp works when paired with the right creator angle. Not because it’s conversational, but because it respects where the buyer actually is.

The strongest creator ads don’t sound confident. They sound curious.

They don’t say, “This is amazing.”

They say, “Here’s what I didn’t get at first.”

They don’t say, “You need this.”

They say, “This was the question I asked before ordering.”

By the time someone taps “Message,” the decision isn’t starting. It’s already halfway formed. The conversation isn’t there to persuade. It’s there to confirm.

When creators are used this way, WhatsApp threads change completely. Fewer dead chats. Fewer vague questions. More specific intent. The AI or human on the other side isn’t explaining from zero. They’re finishing a thought the buyer already had.

Timing matters here. January is one of the few windows where this setup is easy to execute properly. Things are quieter. CPMs are lower. There’s room to test angles without pressure. The teams that move early get clean signals. The ones that stall spend the month chasing creators instead of learning.

Speed of sourcing becomes the bottleneck. Platforms like Insense solve that by turning one brief into usable creator content quickly, with creators who already fit the buyer and assets that can ship straight into Meta, TikTok Shop, Spark Ads, or Partnership Ads.

If this needs to be live while January is still forgiving, book a free demo by January 23 to get $200 toward your first campaign.

When creators are positioned to start the right question, everything downstream gets easier.

The conversation shortens. Trust shows up faster. And buying feels like a decision the customer made themselves. That’s the difference between sending traffic and guiding intent forward.

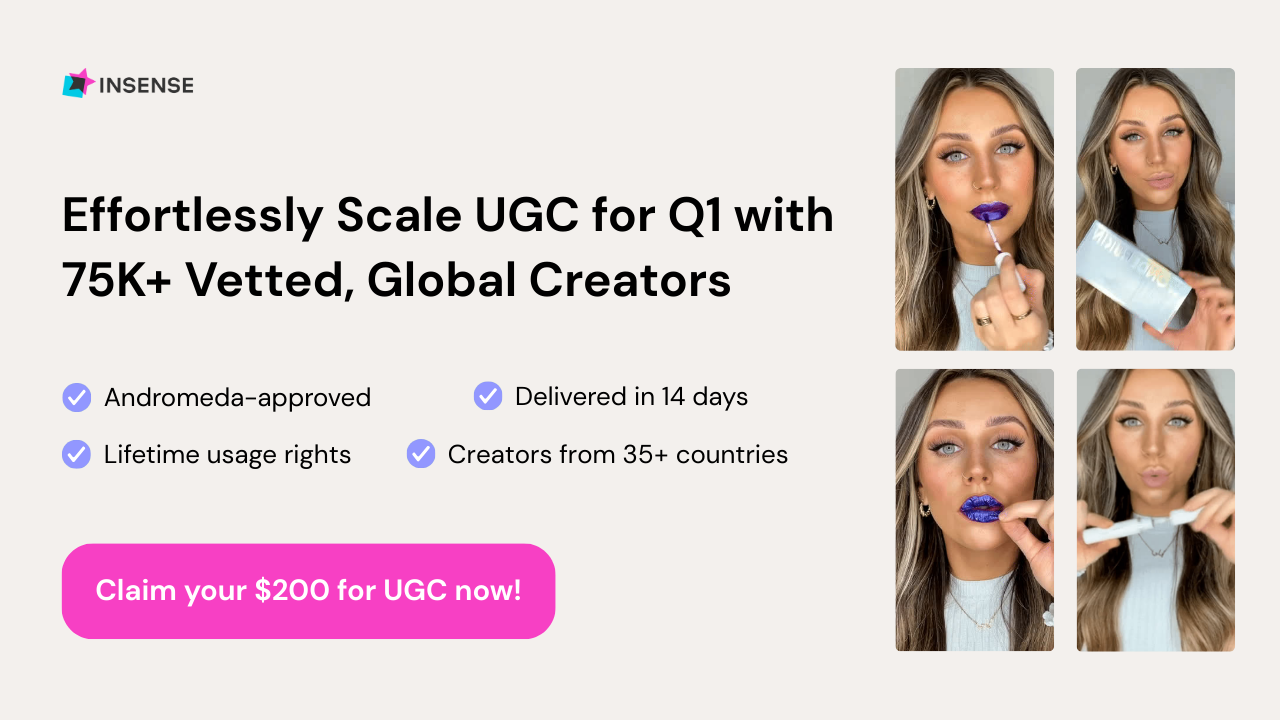

Together with Insense

Scale UGC in Q1 Without Scaling Your Workload

Q1 is when teams reset budgets, launch new angles, and need fresh creative fast. The problem is UGC production turns into spreadsheets, follow-ups, and bottlenecks right when you’re trying to move quickly.

Insense keeps your Q1 pipeline moving. Tap into a vetted marketplace of 75,000+ UGC creators and micro-influencers across 35+ countries. Collaborate with multiple creators at once across diverse campaign types.

Each creator delivers 20+ raw clips you can mix and match into multiple paid social variations, with lifetime usage rights. Everything is delivered in 14 days or less.

Over 2000+ brands like Beauty Pie, Bones Coffee, Flo Health, and Aceable scale UGC by sending one creator collab to dozens of creators at once, then remixing the raw clips into new ad variants.

Across the platform:

- Quip hit an 85% influencer activation rate with product seeding

- Revolut partnered with 140+ creators for 350+ assets

- Matys Health drove 12x reach with TikTok Spark Ads

Book a free discovery call by January 23rd, and get $200 toward your first campaign.

📱 TikTok’s 2026 Playbook for Growth & Commerce

TikTok is giving marketers a clearer picture of where content, discovery, and shopping are heading in 2026. Between new cultural trends and AI-led commerce tools, the platform is shaping how brands create content and convert attention into sales.

The Breakdown:

1. Reali-TEA - Highly polished content is losing its edge. TikTok is pushing brands to show real product usage, everyday moments, and behind-the-scenes content that feels honest and relatable, helping audiences trust brands faster.

2. Curiosity Detours + Emotional ROI - Users are moving toward niche interests and want clearer reasons to care. Brands that speak directly to specific communities and clearly explain why a product matters can drive stronger interest, not just surface-level engagement.

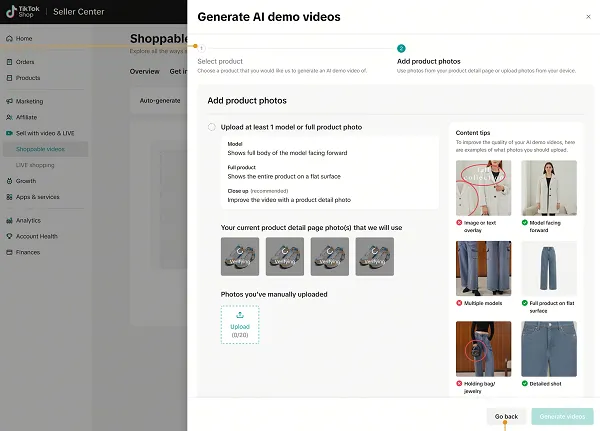

3. AI-Powered Content Creation - TikTok is making content creation easier with AI tools that turn product images into videos, add voiceovers, and generate scripts, helping brands publish faster without needing heavy production or creator dependency.

4. Simpler TikTok Shop Selling - New AI listings, review integrations, and CRM tools reduce the work needed to sell on TikTok Shop. Brands can set up product pages, showcase reviews, and run promotions more easily within the platform.

Together, these updates show TikTok tightening the loop between discovery and purchase. As budget share keeps shifting toward platforms that simplify both content and commerce, brands that move quickly and communicate value clearly will have an advantage.

🚀Quick Hits

🧠 Customers do not experience your funnel; they experience delivery. Shipfusion exposed how fulfillment accuracy outweighs speed in shaping trust across all DTC verticals. The same gaps appear regardless of product. Download the DTC Delivery Files and see where expectations break.

🚀 Meta is paying Wikimedia for premium Wikipedia access, giving its AI cleaner, structured knowledge at scale. It’s a data arms race move that boosts accuracy, freshness, and defensibility against rivals fast.

💸 Google just added campaign total budgets for Search, Performance Max, and Shopping, letting advertisers lock in a fixed spend across a set timeframe so Google auto-paces delivery, reduces daily budget tweaking, and avoids overspend risk.

🔒 98% of shoppers say data transparency drives trust, yet 46% still feel uneasy sharing personal info, even after 95% shopped online this holiday season, and 43% only trade more data for clear financial rewards.

🛍️ 67% of weekly social users bought after seeing a product on social media, and nearly 60% say influencers drove the purchase, with 30% spending $500+ yearly, 57% feeling regret, and 27% using BNPL to keep up.

That’s a wrap for today! Tell us your thoughts about today's content as we line up more Shorts! And don’t hesitate to share this with someone who’d adore it. 🥰