Cashflow Is the Real CPM

🏦Cushion the runway before scale collapses. The AI Search Visibility Divide, and more!

Hey there Smarty 👋

Are you geared up to catch the latest and greatest in quick shorts?

And just a quick heads-up! If you stumbled upon us through a friend, make sure to subscribe here! That way, you’ll never miss out on the trending shorts.

🧯 The Cashflow Cushion Strategy

What if your outbound pipeline could subsidize your ad spend runway?

When Meta payback windows stretch past 90 days, you’re no longer just battling CAC; you’re fighting time itself. $300K in trapped capital, volatile CPMs, and a December forecast held hostage by January’s revenue. That’s not a growth ceiling. That’s a liquidity crisis.

This is where smart brands stop optimizing ads and start rerouting capital.

DTC ≠ Your Only Revenue Clock

Think of your business as running on two clocks:

- The Fast Clock: DTC channels, where ad spend hits, and 60–120 days later, you might see profit.

- The Slow Clock: Wholesale, where Apollo-sourced buyers inject upfront cash that settles in 14–30 days.

The smartest brands don’t pick one. They sync the clocks to create a buffer.

Apollo lets you precision-build those buffers by reverse-searching B2B buyers already consuming your DTC brand signals. You’re not cold-pitching, you’re cashflow-aligning.

The SKU Allocation Play

This is where most operators fumble:

You can’t wholesale your entire catalog without cannibalizing DTC.

You segment by margin x velocity:

- High-margin, high-velocity SKUs → Stay in DTC

- Medium-margin, excess inventory → Apollo outbound

- Low-margin, brand-safe overstock → Wholesale filler to stabilize unit velocity

Apollo makes it surgical, allowing you to isolate regions, categories, and even rep-triggered patterns of buyer demand. You can try Apollo for free here.

Forecasting That Actually Feeds Liquidity

The final edge isn’t in who you pitch. It’s when you pitch.

Use Apollo’s outbound scheduling to time cash injections during:

- Meta cost spikes

- Fulfillment lulls

- Q4 prep cycles

Now your sales calendar feeds your ad runway, not the other way around.

Bottom Line

When every DTC dollar stretches thinner, the smartest brands stop chasing better ROAS and start locking cashflow. The Cashflow Cushion Strategy isn’t a detour from growth; it’s the system that lets you survive long enough to scale.

Together with Insense

💡 1 Creator. 20+ Scroll-Stoppers. All in Your Hands by Next Week.

Sourcing creators is slow. Editing takes forever. And testing? You never have enough assets.

Insense fixes all three.

Here’s how it works:

Send one brief → get 20+ raw and edited videos per creator in under 2 weeks.

Test multiple hooks, CTAs, visuals, and value props, all from a single shoot.

From Spark Ads and influencer gifting to TikTok Shop and Meta Partnership Ads, you’ll finally have the variety you need without killing your team.

That’s how 2000+ brands like Solawave, Nurture Life, and Maty’s scale creative across every channel.

Every asset comes with full rights and costs under just $150 per creator.

Book your free strategy call by September 5th and get $200 toward your first campaign!

🤖 Google AI vs ChatGPT: A Brand Visibility Split

AI search is reshaping discovery, but new BrightEdge data shows brands can’t expect consistency across platforms. ChatGPT, Google AI Overviews, and AI Mode rarely align, fracturing exposure and leaving marketers with a moving target.

The Breakdown:

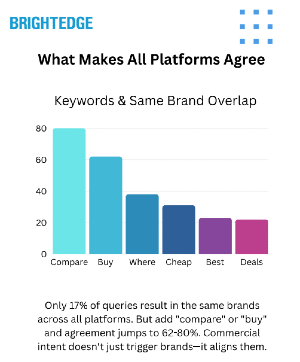

1. Platforms Rarely Agree on Brands - Across tens of thousands of prompts, ChatGPT and Google disagreed on brand recommendations nearly 62% of the time. Only 17% of queries surfaced the same brands across all three platforms.

2. Google Mentions More, ChatGPT Stays Silent - Google AI Overviews averaged 6.02 brand mentions per query, far higher than ChatGPT (2.37) and AI Mode (1.59). ChatGPT failed to mention any brands in 43.4% of queries, while AIO stayed silent just 9.1% of the time.

3. Citations vs Mentions Show Diverging Strategies - Google’s AI tools cite far more than they mention, with AIO generating 14.30 citations on just 6.02 mentions. ChatGPT flips that dynamic, offering 3.2x more mentions than citations.

AI-driven visibility is not uniform or predictable. Success depends on optimizing for multiple systems, from Google’s citation-heavy approach to ChatGPT’s pattern-based mentions. This fragmentation represents both a challenge and an untapped opportunity; those who adapt quickly can capture share in a volatile but highly visible new search frontier.

🚀Quick Hits

⚡ The first order is where retention is won or lost, no matter your category. Shipfusion tracked 110 cosmetic brands and found that only 31% offered free returns, 75% skipped upsells, and nearly half used generic unboxing. Beauty, wellness, apparel, pet care, every category is making the same costly mistakes. Download the report and start fixing them.

📩 TikTok added new DM features, including one-minute audio messages, plus photo and video attachments in one-on-one and group chats, alongside safety controls like blocking media in initial requests.

📥 Instagram added new DM management tools, including inbox filters (story replies, unread, unanswered, followers, verified), customizable shortcuts, and user-created folders.

📊 A new survey of 1,500 U.S. users shows Google’s share of everyday searches slipping from 73% to 66.9%, while ChatGPT nearly tripled to 12.5%, and daily AI tool use doubled to 29%.

📉 The U.S. ad market posted its first decline in 22 months this July, with spending down 5.6% year-over-year, driven by steep 22% drops in national TV due to tough comparisons against last year’s Olympics and political ads.

That’s a wrap for today! Tell us your thoughts about today's content as we line up more Shorts! And don’t hesitate to share this with someone who’d adore it. 🥰